Problem 10: Not All Customers

Are Equal; Far From It

Not all customers are financially equal. The differences can be extreme in B2B.

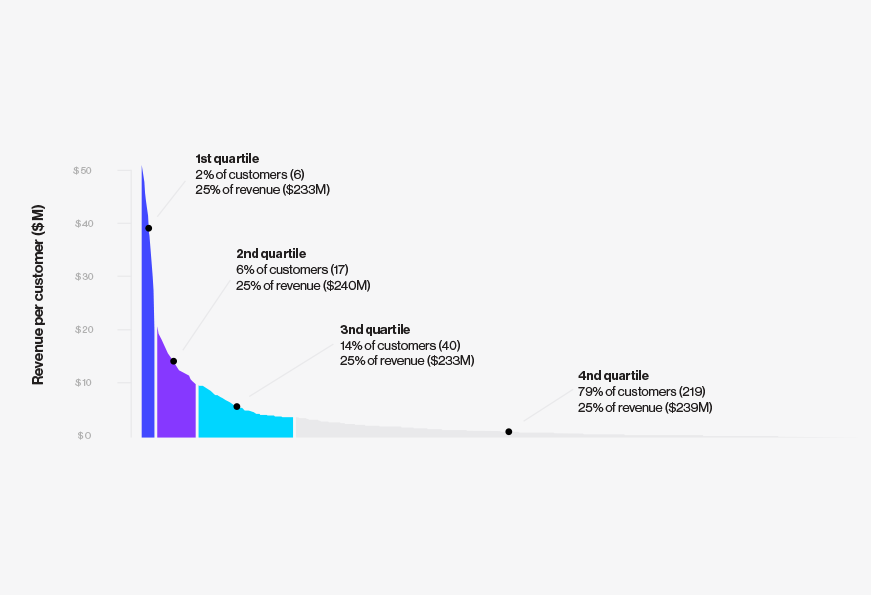

Most customer research considers all customers to be equal. This is particularly problematic in B2B situations. Most B2B companies have customer profiles that form a quite extreme Pareto curve. A tiny fraction of the customers can represent a majority of the revenue and gross margin. If these customers are treated exactly the same as the others the result is often a financial disaster.

Your largest customers know that they are your largest customers. They know that they are special. They expect to be treated that way.

The diagram below is not an unusual customer profile.

Source: OCX Cognition, Pareto Diagram – Revenue by Customer.

Customer research practices tend not to differentiate

Most companies have customer research practices that treat the six customers in the first quartile above exactly the same as any six customers in the fourth quartile. Their improvement requests carry the same weight. The same research methods are used. This is absurd!

When it comes to customer research, differentiate your approach. Examine a large customer’s organization chart to determine the decision makers, influencers, and end-users. Talk to a representative cross section of each. Make sure they are getting the ROI they expect from your products and services.

For some companies, that effort may be sufficient. If your products and services are not highly customized for large customers, improvements you make for your most important customers flow down to the others.

“All animals are equal, but some animals are more equal than others.”

– GEORGE ORWELL

Customer Advisory Boards

An alternative form of research for the largest customers is to invite them to join a Customer Advisory Board. Don’t be too flattered if they say yes! The main thing customers appreciate in such boards is the opportunity to talk with their peers in other companies. Agendas need to be planned in a way that allows such interaction.

If you have a Customer Advisory Board, remember who is supposed to be doing the advising! (They are!) If you treat is as a sales or marketing opportunity, you miss the point.

Financial risks

From a financial perspective, customer profile and NPS status have considerable, compounded impact. Two factors come into play.

First, the largest customers tend to receive the greatest discounts from list prices. They have more negotiating power than smaller customers.

Second, gross margins are usually quite different for Promoters, Passives and for Detractors. In B2B situations, we tend to spend a lot of time and money on Detractors, trying to turn them around and keep them loyal. Promoters have few problems and are less likely to try to negotiate discounts. Passives are in between the other two.

Corporate profitability challenges arise when your largest customers are Detractors. Some may be unprofitable for you. A simple question arises: do you keep spending money to try to retain them, or do you bid them adieu?

oAnother question: is the balance of power between your two companies healthy enough to allow you to discuss the profitability problem openly? Just as in human relationships, money issues are a frequent cause of breakups.

Physical distance matters too

If you find you have large Detractors, an additional factor may indicate that ending the relationship with them is the best option. Think of the human situation where one member of a couple is never around. Communication can be challenging. Suppose that you have a large, unprofitable Detractor whose headquarters and purchase decisions are physically located in another country. Suppose too that you and your partners have little or no presence there. A break-up may be inevitable, and wise.

Complex solutions with partnerships

Finally, consider the specific situation of large B2B customers who have bought complex solutions which involve other companies’ products and services. A challenge that we frequently observe is that no single company takes responsibility for customer issues (unless, of course, they’re good issues). When problems arise, finger-pointing is common. Your customers see this.

The blame game comes across as highly unprofessional. The only formal way to handle such situations is the appointment of a lead contractor. The non-lead companies have to be prepared to sacrifice some margin to allow the lead contractor to handle these responsibilities.

Conclusion

In short, the highest financial risks arise with unhappy customers who have complex solutions and who are physically located a long way from your center of gravity. At the very least, you should assume that they will be less happy than the average. And at most you should consider assigning the resources necessary to counter these factors.

Bear in mind that it can be OK to give up.

ABOUT INSIGHTS FROM OCX COGNITION

OCX Cognition delivers the future of NPS. We ensure customer experience success by combining technology and data science with programmatic consulting. In our Insights section, we present a comprehensive and evolving collection of resources based on our research and expertise, collected for CX leaders committed to delivering business outcomes.